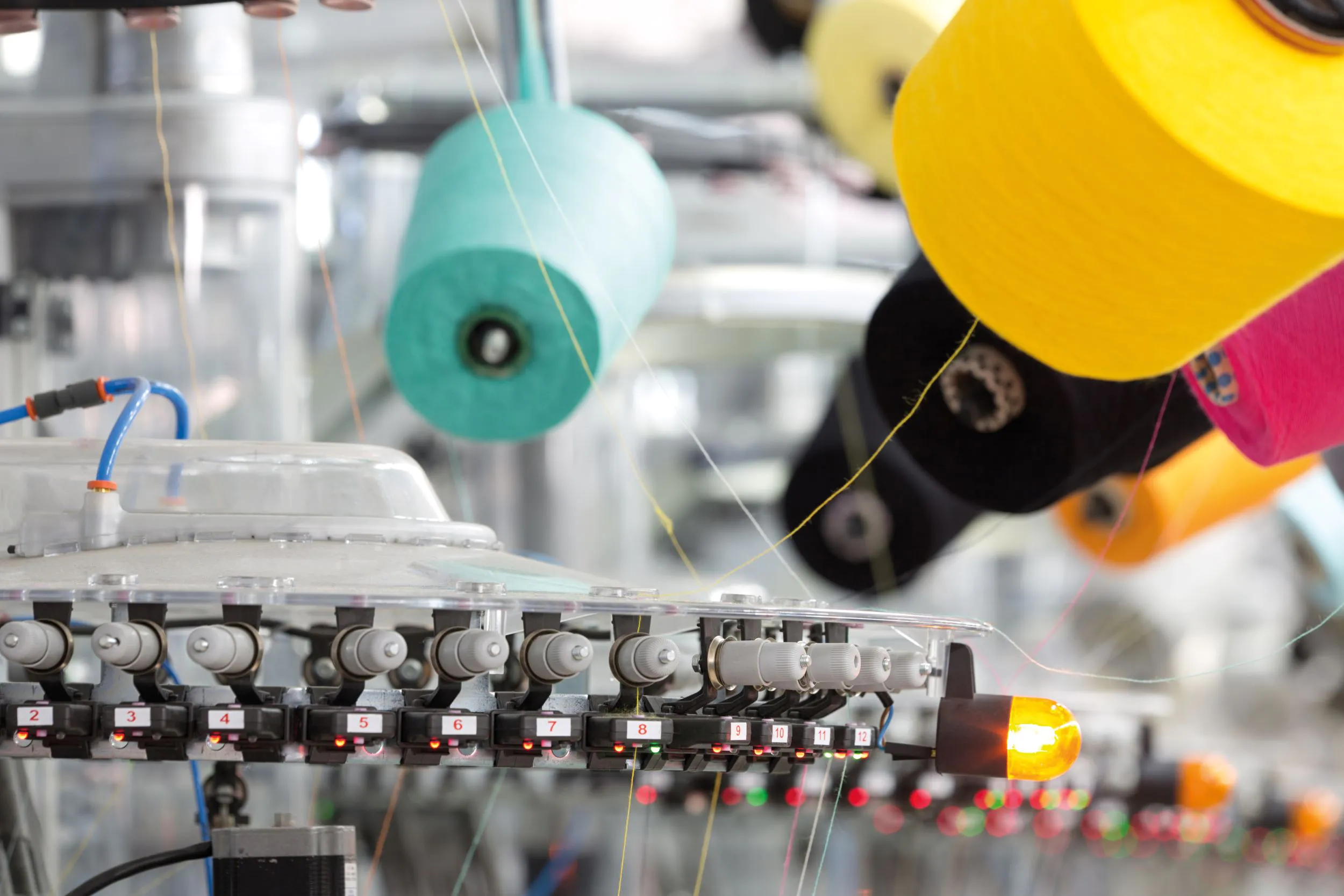

The textile and apparel industry in Thailand plays important role in the country’s GDP and export earnings. With over 50 years of development, Thailand’s textile and apparel production has become an integrated and diverse industry that covers a wide range of products, everything from synthetic yarns to wool fabrics, cotton bed linens to technical textiles, and t-shirt to high-end fashion garments.

Thailand is well-known around the world for being one of the world’s largest producers for fabric, sportswear, kidswear, womenswear and casualwear. Thailand is also a world-renowned silk producer, as well as a spin or twist yarn producer. Moreover, the country’s exquisite finishing, dyeing, and printing services also make it one of the most popular textile outsourcing destinations in the global market.

Thailand currently has around 4,500 textile and apparel manufacturers employing almost one million workers. These manufacturers, most of them located around Bangkok and in eastern Thailand, range from man-made fiber plants, spinning and weaving, to dyeing and printing. Most of Thailand’s textile companies are also part of the ASEAN’s integrated textile supply chain. For example, Bangkok Weaving Mills Groups, delivers pre-dyed fabrics by road to Cambodia, where another factory cuts and sews them for international fashion brands.

In 2014, Thailand exported $7.52 billion worth of textile and apparel products, according to WITS data, of which $3.42 billion worth of textiles and apparel were exported to east Asia-Pacific, while $1.24 billion worth of apparel, brassieres and other types of clothing items were shipped to the United States, reported by Thai Trade USA. But these top export numbers are offset by imports worth $4.71 billion made in the same year. Most imports also came from east Asia and the Pacific market.

One of the biggest current challenges Thailand’s textile and apparel industry faces is the lack of domestic demand, mainly caused by low domestic purchasing power, which forces Thailand to sell its textile and apparel products to foreign markets. Another big challenge is the lack of raw material in its garment production. For example, Thailand’s textile industry consumes about 500,000 tonnes of raw cotton, but the nation can only produce around 2% of the raw cotton it requires.

Despite different challenges, the National Federation of Thai Textile Industries still believes that its country’s textile and apparel industry has strong potential to grow and add higher value, thanks to the new policies issued by its government in 2016. Under the new promotional initiatives, Japanese investors have expressed interest in producing textiles for medical use in Thailand and making the country a regional hub for innovative garments and medical equipment.

Thailand believes the new opportunity for its textile and apparel industry is to take the next step into high-tech garments. The sector needs to transform from the lower market where competition is huge with countries having low labour costs, such as Bangladesh, Vietnam, and Cambodia, to innovative products with fewer competitors and higher added value.

Thousands of Thailand’s leading textile companies can be in your contact list if you join 91��Ƭ�� today! Whether you are looking for reliable suppliers, top textile manufacturers, wholesalers and potential customers in over 70 major countries, or benchmarking what your competitors are buying and which suppliers they’re using, 91��Ƭ�� can help you connect with sales prospects in the textile industry across the globe.

Register for free now to build your own network of global textile companies on 91��Ƭ��