The Current State of the Jewelry Industry

They say history repeats itself, and going by the trends from the last three decades in the apparel industry, it seems to be playing out again. This time in the jewelry industry, and it’s unfolding at a much faster pace. The jewelry industry seems poised for a promising future. Sales in the global jewelry industry are expected to grow at a rate of 5 to 6 percent every year, reaching. The global jewelry industry is reached annual global sales of 161 billion USD and expected to grow at a healthy clip of 5 to 6 percent each year, totaling 272 billion USD by 2020. Consumer demand for jewelry is as promising as ever in 2020.

Today, the jewelry industry is still primarily local. The top 10 jewelry brands in the world capture 11 percent of the worldwide market. The rest of the market consists of strong national retail brands, such as Christ in Germany or Chow Tai Fook in China, and small or midsize enterprises that operate single-branch stores.

This fact sheet is for you if you are trying to figure out:

- How the market is evolving?

- What are the future challenges and opportunities in the jewelry industry?

- What are the implications for different market segments?

- What are the future trends of the jewelry industry?

91��Ƭ�� is already helping dozens of jewelry, luggage, and leather goods dealers connect. See how 91��Ƭ�� can help you too.

Jewelry Industry Overview?

The global jewelry industry is valued at USD 272 billion in 2020 and is anticipated to witness significant growth over a few years. The biggest jewelry industry trends driving this growth are increasing disposable income and innovative jewelry designs offered by manufacturers.

Top Jewelry Industry Trends Driving Growth

- Large client bases in the jewelry industry driving demand.

- Introduction of new jewelry designs.

- Emerging fashion trends.

- Innovative products being pushed by the top jewelry brands.

- Changing lifestyle and the perception of jewelry as a status symbol.

- Growth in men’s jewelry marketing driving growth.

- Fast-growing men’s jewelry products such as cufflinks, plain gold chains, cufflinks, tie bars, cartography necklaces, and signet rings.

An emerging trend in the global jewelry industry is the growth of the bridal jewelry market. In countries like India, a wedding is a huge affair full of traditions and rituals and jewelry is a huge part of that. It’s not just weddings, gold earrings and necklaces are no longer limited to weddings and functions. Men and women both wear rings, plain gold chains, and anklets as a fashion statement. Earrings and bracelets are also gifted on various occasions or events like birthdays and anniversaries. This consumption behavior is expected to positively impact market growth.

Demand in the Global Jewelry Industry

In 2019, the global luxury jewelry market amounted to about 23 billion USD. The largest share if the luxury jewelry market revenue is attributed to China, followed by the United States, Japan, and India. The value of the jewelry market is expected to increase from about 272 billion USD in 2020 to about 480.5 billion USD by 2025. Driving this demand is being led by lab-created diamonds, which are often indistinguishable from natural diamonds, and are expected to become much more common and readily available in the near future.

The demand for gold worldwide has increased from over 3.1 thousand metric tons in 2007 to around 4.4 thousand metric tons in 2019. There are several different industries that use gold, but the largest of these is the jewelry industry. In 2017, the jewelry industry used over 2.1 thousand metric tons of gold, accounting for a little over half of all gold demand worldwide. Regionally, China and India account for the largest share of global gold jewelry demand.

Value of the Jewelry Industry?

Compared to the Apparel Industry

The average deal value in jewelry has been rising—by a compound annual growth rate of 9 percent between 1997 and 2012, compared with 5 percent in apparel. Recent deals include British company Signet Jewelers’ 2012 acquisition of US-based retailer Ultra Diamonds and the Swatch Group’s acquisition of Harry Winston in January 2013.

Going by annual sales, the apparel industry is about ten times the size of the jewelry industry. The average M&A deal in the global jewelry industry grew at a CAGR (Compound Annual Growth Rate) of 9 percent, compared to the apparel industry where the growth was 5 percent.

Top 5 Jewelry Industry Statistics

- Specialty jewelers generate more than 43% of the industry’s total United State sales.

- The jewelry industry is primarily based on how the economy grows or falls. During the Great Recession, the industry saw an 11% drop.

- The top three markets for luxury jewelry are Europe, China, and the United States.

- Specialty jewelers are losing market share to retailers, wholesalers, and manufacturers.

- Americans spent about 68.43 U.S. dollars on watches per consumer unit.

Top 5 Retailers of Jewelry Sales

Here are the top 5 retailers by jewelry sales.

- Wal-Mart – $2.9 billion

- Sterling Jewelers Inc. – $2.536 billion

- Zale Corp. – $2.138 billion

- Tiffany & Co. – $1.547 billion

- QVC – $1.390 billion

Walmart remains the largest retailer in the world in terms of jewelry sales, followed by Sterling Jewelers Inc. and Zale Corp. rounding out the top 3.

Revenue by Jewelry Industry Segment

- Fine jewelry saw increased 6% with total sales of $61.9 billion.

- Fine watch sales increased 5.8% with total sales of $9.4 billion.

- Wholesale jewelry suppliers increased by 2.4%.

- Diamonds saw a revenue of $27 billion with 40% of the global demand being consumed by the United States.

Ranking the Top 10 Jewelry Brands in the World 2020

10. Harry Winston

- Country: USA

- Revenue (2011): $279 million

9. Chopard

- Country: Switzerland

- Revenue (2018): $800 million

8. Pandora Jewellers

- Country: Denmark

- Revenue (2017): $3.47 billion

7. Chow Tai Fook

- Country: Hong Kong

- Revenue (2018): $3.7 billion

6. Tiffany & Co.

- Country: USA

- Revenue (2018): $4.17 billion

5. Rajesh Exports

- Country: India

- Revenue (2018): $4.7 billion

4. Cartier

- Country: France

- Revenue (2018): $7.4 billion

3. Signet

- Country: USA

- Revenue (2018): $6.25 billion

2. Chanel

- Country: France

- Revenue (2017): $9.6 billion

1. LVMH – Moët Hennessy Louis Vuitton

- Country: France

- Revenue (2017): $52.9 billion

Largest Trading Partners – Jewelry Imports and Exports

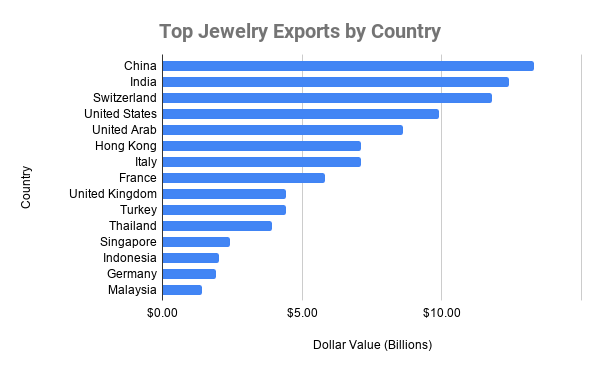

Top Jewelry Exports by Country

Here are the 15 countries that exported the highest dollar value worth of jewelry in 2018.

- China: US$13.3 billion (12.9% of total jewelry exports)

- India: $12.4 billion (12%)

- Switzerland: $11.8 billion (11.4%)

- United States: $9.9 billion (9.6%)

- United Arab Emirates: $8.6 billion (8.3%)

- Hong Kong: $7.1 billion (6.9%)

- Italy: $7.1 billion (6.8%)

- France: $5.8 billion (5.6%)

- United Kingdom: $4.4 billion (4.3%)

- Turkey: $4.4 billion (4.3%)

- Thailand: $3.9 billion (3.7%)

- Singapore: $2.4 billion (2.3%)

- Indonesia: $2 billion (2%)

- Germany: $1.9 billion (1.9%)

- Malaysia: $1.4 billion (1.3%)

- These countries shipped 93.3% of global jewelry exports in 2018 by value.

- Among the top exporters, the fastest-growing jewelry exporters since 2014 were: France (up 27.7%), Germany (up 18%), Switzerland (up 8.9%) and Italy (up 1.8%).

The Future of the Jewelry Industry

The global jewelry industry will continue its climb in the future as long as the demand is there. As global jewelry industry trends continue shape the way for the sector, manufacturers and sellers must actively promote a culture of innovation to move things forward.