COVID-19 Automotive Industry Trends

The COVID-19 pandemic presents many challenges for the automotive industry, including the worldŌĆÖs top automakers. On top of nearly universal challenges such as lockdowns, physical distancing, and supply chain disruptions, auto brands face decreased demand as consumers do less travelling and are less financially secure. While many leading car manufacturers are already beginning to recover from the early months of the pandemic, the second wave hitting many countries around the world may cause another fall in sales, and experts predict that the automotive industry as a whole will not hit pre-pandemic levels until 2021 or beyond.

According to Statista, global automotive industry sales are expected to fall from their peak of close to 80 million units in 2017 to 62 million units in 2020. The Chinese auto market was hit particularly hard in February this year, with many factories closed completely during the COVID-19 outbreak. However, those factories have reopened and the Chinese market has already begun to recover, showing improvements as early as April. Prospects for the global automotive industry vary from country to country, depending on factors such as how severe the pandemic is in those regions, as well as what if any government aid is available to businesses. Overall, demand for new motor vehicles is expected to be negative throughout 2020.

How Auto Industries in Different Countries are Impacted by COVID-19

Automotive business intelligence firm JATO Dynamics reported a 43% fall in global automotive sales, with China being the industryŌĆÖs primary driver of growth. This may be to the benefit of Chinese auto brands, as OEMs in locations such as Japan, the US, and Europe struggle under the pandemic. To help local players stay competitive, several Chinese cities have introduced incentives such as subsidies for new energy vehicles sold this year. Existing subsidies are also being extended, and new infrastructure such as charging stations is also being built.

China isnŌĆÖt the only market thatŌĆÖs been pulling its way out of downward automotive industry trends. Other countries that have gotten the spread of the pandemic under control, such as Japan and Korea, will likely recover faster than many other parts of the world where growth continues to slow or decline.

The pandemic even has the potential to boost car ownership, as consumers choose the safety of driving their own vehicle rather than taking public transit or other shared transportation options. In addition, automobile manufacturers in developing countries may have an edge over those in developed nations. Emerging markets such as China and India are still growing, with large populations that need infrastructure and a rising average income that means more people can afford expenses such as vehicles. While many countries face decreasing GDPs in 2020, some emerging nations are expected to grow despite the pandemic, which will help insulate manufacturers in those countries from the full impact of COVID-19.

Future Outlook for the Global Automotive Industry

Automotive industry trends brought on by COVID-19 will not all disappear once the pandemic ends. While many setbacks will be gone, some habits and process changes developed due to the coronavirus will remain in place. For example, many people are expected to continue working from home some or all of the time, reducing commutes and lowering demand for vehicles. Top auto brands need to anticipate this trend and adapt both their marketing and their product lines to cater to users who no longer need to drive as frequently or in the same conditions and settings.

Changing Automotive Industry Trends and Opportunities

COVID-19 disruptions arenŌĆÖt the only automotive industry trends that automakers need to look out for. The growing concern over the environment and the implementation of initiatives such as the Paris Agreement mean that automotive manufacturers need to change and adapt their product lines in order to meet new standards and expectations.

JATO Dynamics expects that 2019 was the peak for internal combustion engine (ICE) vehicle sales, a category that has typically accounted for over 90% of total vehicle sales worldwide. The combination of COVID-19 challenges, evolving consumer behavior, and pressure to produce more environmentally friendly vehicles means that ICE adoption will decline, and electrified vehicles will gradually move in to fill the gap.

Many countries around the world are strengthening restrictions on automotive emissions, which is pressuring automotive manufacturers to develop or expand their electric vehicle lines. Statista predicts that by 2025, one in three new cars sold will run solely or partially on an electric battery. While Tesla currently leads the global electric vehicle market, delivering 367,000 cars in 2019 and holding 1%-2% of the US automotive market, many top automakers are ramping up development of their own electric vehicle offerings, promising to introduce more variety into the market and present consumers with a greater range of electric vehicle options.

Differentiation will be key for the worldŌĆÖs top automotive manufacturers, especially in the face of TeslaŌĆÖs current market dominance when it comes to electrified vehicles. Offering consumers electric cars that are cheaper, travel farther between charges, are better suited to certain environments or driving conditions, or otherwise stand out from the competition will help auto brands remain relevant in an industry transitioning into a new set of standards and expectations.

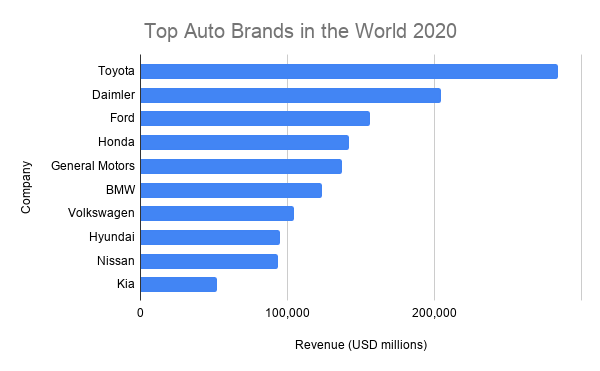

Who are the Top Auto Brands in the World in 2020?

COVID-19 is creating some challenging automotive industry trends, and not even the largest automotive manufacturers are immune to an event with such a heavy impact on the global market. However, the industryŌĆÖs leading automakers are still in business, and many are already recovering and planning for the future.

Ford continues to be one of the worldŌĆÖs leading car manufacturers, with the Ford F-Series being among the best-selling light vehicles in the world. However, there are currently few other American automakers among the industryŌĆÖs top brands, which consist primarily of European and Asian manufacturers.

Company |

Revenue (USD millions) |

| Toyota | 284,170 |

| Daimler | 204,156 |

| Ford | 155,900 |

| Honda | 141,772 |

| General Motors | 137,200 |

| BMW | 123,159 |

| Volkswagen | 104,479 |

| Hyundai | 94,653 |

| Nissan | 93,801 |

| Kia | 52,049 |

Which Automotive Manufacturers Lead the Market Near You?

For more on global automotive industry trends and to connect with top auto brands from around the world, check out 91ųŲŲ¼│¦ŌĆÖs global marketplace.